See also

10.05.2024 05:09 AM

10.05.2024 05:09 AMEUR/USD

Yesterday's rather soft Bank of England meeting, where two members of the Committee spoke in favor of a rate cut, could not overcome the general risk sentiment set by the stock market - the S&P 500 rose by 0.51%, the dollar index fell by 0.29%, the euro rose by 33 pips.

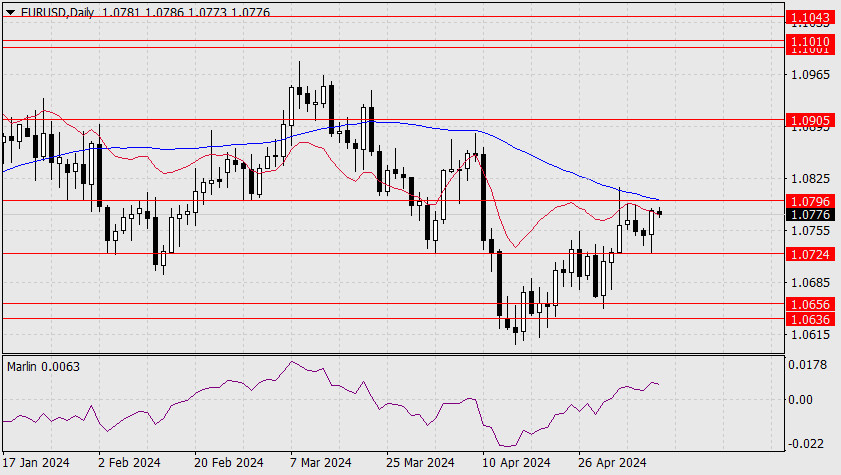

This morning, the price climbed above the balance indicator line on the daily chart, so it has a chance to work off the key resistance at 1.0796 (February 29 low). The MACD line is close to this level, so consolidating above it will allow the euro to reveal an alternative plan so it can rise to the target level of 1.0905. Also, the level of 1.0796 coincides with 50% of the corrective move from March 8-April 16. The main scenario assumes a price reversal, moving away from 1.0724 and heading towards the target range of 1.0636/56.

On the 4-hour chart, the price is trading in the range of 1.0724/96, above the balance and MACD indicator lines. The Marlin oscillator has entered the positive area, but it seems to have plans to move back into the downtrend territory. The price will encounter one more support on the way to another support level at 1.0724 - the MACD indicator line, so the way to this support may take around 2-3 days.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.