See also

10.05.2024 05:09 AM

10.05.2024 05:09 AMGBP/USD

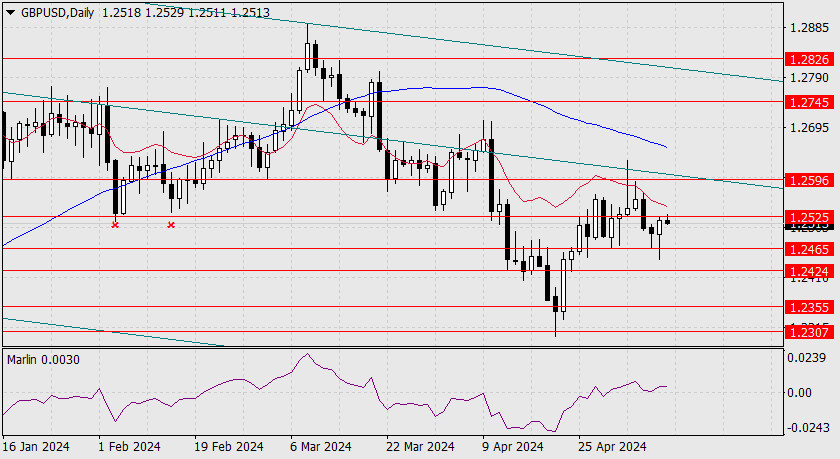

The Bank of England meeting showed that two members of the Monetary Policy Committee voted in favor of a rate cut. We expected the exact distribution of votes (2-7), but the general market forecast suggested no more than 1 vote for a rate cut. The pound's initial reaction was to fall and lose more than 40 pips, as it was bought back while counter-dollar currencies and stock markets broadly strengthened. As a result, the quote reached the target resistance of 1.2525.

If the price can overcome this resistance, it will face many strong intermediate resistance levels on the way to the target level of 1.2596, which can only be fought with full support from related markets and fundamental factors.

Today, the UK will release important data: Q1 GDP with a forecast of 0.4%, industrial production for March with a forecast of -0.5%, trade balance for March with a forecast of -£14.5 billion vs -£14.2 billion in February. The forecasts are mixed, so market participants will wait for incoming data and correlate it with the general market sentiment. We expect the pound to weaken.

On the 4-hour chart, the price is stuck in the indicator lines coinciding with the target resistance at 1.2525. The Marlin oscillator is moving sideways just above the zero line. We are waiting for a price reversal and the pound to climb to the support at 1.2465. If the price does consolidate above 1.2525, we will refrain from rushing to extend the outlook to 1.2596, since a similar drop from April 30 may follow.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.