See also

07.05.2024 09:32 AM

07.05.2024 09:32 AMThe eurozone producer price index rose from -8.5% to -7.8%, but it had no effect on the situation, and the single currency stood still all day. Of course, we can say that this report was not crucial, but that wouldn't be right. After all, we are talking about the component part of inflation, which is an indicator of further dynamics. And considering that the dollar is still overbought, even small hints of inflation growth in Europe should support the euro. The reason why the market is stable is partly because the previous report was revised. The rate of decline increased from -8.3% to -8.5%. This offset the effect of the slowdown.

Today, the single currency will get another chance to strengthen. This time it will be the retail sales report. The rate of decline is expected to slow down from -0.7% to -0.3%. And it turns out that consumer activity in Europe seems to be increasing, coupled with a hint of rising inflation. Which from the financial markets' perspective is a great thing.

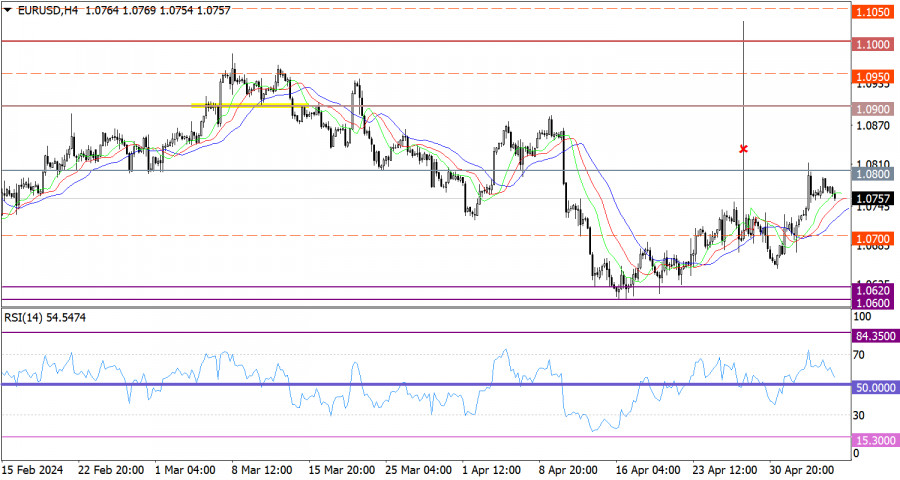

The EUR/USD pair has pulled back from the resistance level of 1.0800. As a result, the volume of short positions increased and this interrupted the upward cycle.

On the four-hour chart, the RSI shows a decline, but the indicator is still hovering in the upper area of 50/70.

On the same chart, the Alligator's MAs are headed upwards, which reflects the bullish sentiment.

The price must settle above the 1.0800 level in order for the volume of long positions to rise. Until then, the retracement stage will persist, and in case the price stays below 1.0750, the volume of short positions may continue to increase.

Complex indicator analysis indicates a pullback from the resistance level in the short- and long-term timeframes.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.