یہ بھی دیکھیں

08.12.2025 09:15 AM

08.12.2025 09:15 AMIt's hard not to be optimistic when the S&P 500 enters a seasonally strong period and the Fed is set to lower interest rates. The broad stock index has risen to its highest level since the end of October. However, profit-taking ahead of the FOMC meeting prevented it from maintaining the local peak. Nonetheless, the outlook for the US stock market remains bullish.

More than three-quarters of asset managers surveyed by Bloomberg are positioning their portfolios for a risk-on market environment. They believe that sustained global growth, ongoing developments in artificial intelligence technology, easing monetary policy from the Fed, and fiscal stimulus will support the equity market.

Market Expectations for 2026

According to Citadel Securities, the S&P 500 will continue its rally due to still light positioning and FOMO. Fear of missing out will drive investors to buy US equities. At the same time, retail investors remain highly engaged, with their firm identifying them as primary price setters.

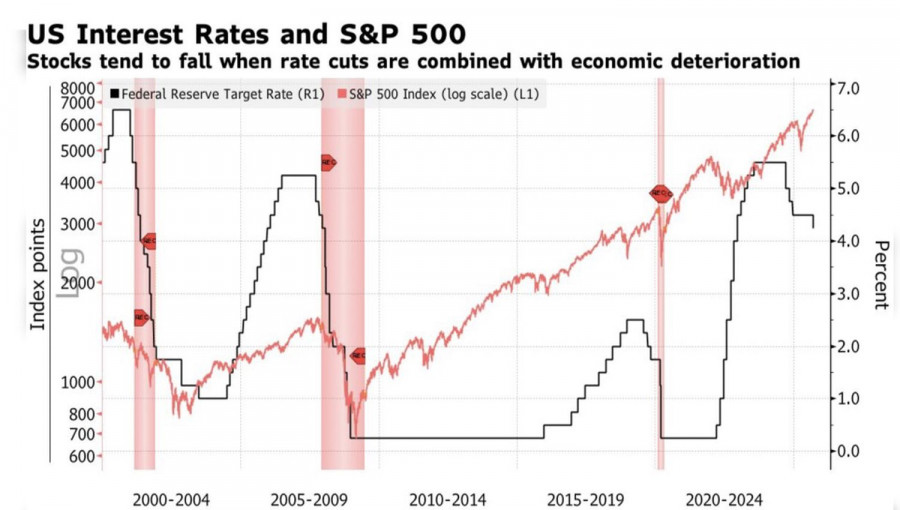

Truist points out that of the seven "bullish" S&P 500 markets that managed to surpass the three-year mark, the average return in the fourth year was 15%. Historical patterns, including high performance of the broad stock index during periods of federal funds rate cuts and gains in similar cycles, suggest that the US stock market rally is far from over.

Dynamics of S&P 500 and Federal Funds Rate

Investors believe in the S&P 500's continued upward trend. According to EPFR, they invested $800 billion into US stock ETFs in just one week, with inflows occurring for 12 consecutive five-day periods. However, there is a warning sign: specialized exchange-traded funds focusing on tech companies saw an outflow of $1.1 billion. This confirms the idea of rotation, indicating a diversification of portfolios from tech giants to small-cap companies.

Bank of America warns that updated FOMC forecasts could result in a pullback for the S&P 500. The broad stock index is rising due to a Goldilocks scenario, where the economy is not too hot to allow the Fed to cut rates and not too cold to start fearing a recession. If the Committee shows fear of a downturn in its assessments or does not satisfy the futures market's desire for two to three acts of monetary expansion in 2026, this could lead to a stronger US dollar and a drop in stocks.

However, considering the expectations for a Christmas rally and the tendency of retail investors to buy the dips, there is little to worry about regarding the fate of the broad stock index.

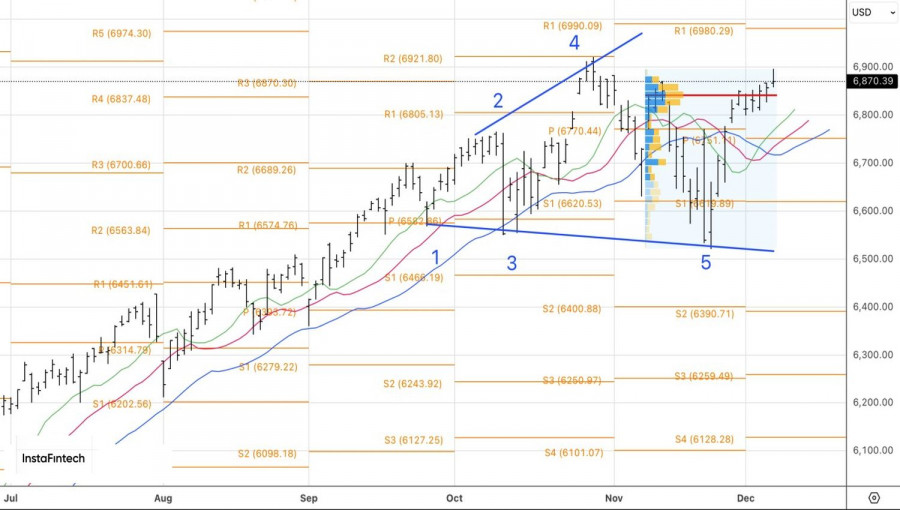

Technically, on the daily chart of the S&P 500, the formation of a candle with a long upper shadow may be the first sign that bulls are running out of steam. Nevertheless, the mood remains positive, and a rebound from fair value at 6,840 or pivot levels of 6,805 and 6,770 presents buying opportunities.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.